The Central Bank of Nigeria (CBN) has announced that its “Naira 4 Dollar” remittance scheme will end on 30 June 2023.

The policy, which was introduced in March 2021 to encourage the inflow of foreign currency, will no longer be in operation as from 1 July, it said.

Under the scheme, the CBN pays out a reward of N5 for every $1 of fund remitted to Nigeria through international money transfer companies, an incentive for senders and recipients of remittances.

Beneficiaries of the “Naira 4 Dollar Scheme” get the incentive payment, whether they collect the remitted dollars as cash across the counter or through their domiciliary accounts.

The CBN has also ended its RT200 programme aimed at improving the inflow of foreign exchange into the market. According to the former CBN governor, Godwin Emefiele, the scheme, established in February 2022, led to increase of US$ 2.6 billion in forex flow in 2022 from non-oil exports.

The end to the “Naira 4 Dollar” remittance scheme and the RT200 programme is part of a series of policy changes announced by the CBN since the assumption of office of President Bola Ahmed Tinubu on 29 May.

The bank has also removed restrictions on the naira exchange, allowing market forces to determine its rate.

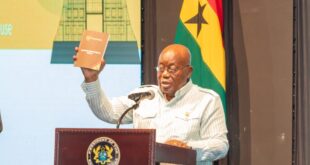

President Tinubu had, during his inauguration speech, unveiled a plan to harmonise the nation’s multiple exchange rates as part of the broad plan to transform Africa’s largest economy. He also announced an end to fuel subsidy, which has been the biggest expenditure in the country’s annual budget for more than 10 years. The move has however seen the price of petroleum products tripling.

Tinubu, who has positively surprised economic watchers by his moves, has also pledged that his administration would expand the country’s gross domestic product (GDP) by “not less than 6 per cent”. Nigeria is currently beset by an economy in downturn, mass unemployment, high inflation rate and pervasive insecurity, causing severe hardship for the population.

Kola Tella

THE AFRICAN COURIER. Reporting Africa and its Diaspora! The African Courier is an international magazine published in Germany to report on Africa and the Diaspora African experience. The first issue of the bimonthly magazine appeared on the newsstands on 15 February 1998. The African Courier is a communication forum for European-African political, economic and cultural exchanges, and a voice for Africa in Europe.

THE AFRICAN COURIER. Reporting Africa and its Diaspora! The African Courier is an international magazine published in Germany to report on Africa and the Diaspora African experience. The first issue of the bimonthly magazine appeared on the newsstands on 15 February 1998. The African Courier is a communication forum for European-African political, economic and cultural exchanges, and a voice for Africa in Europe.