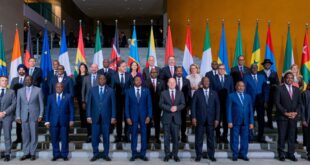

German Chancellor Angela Merkel has called for more private investment in Africa as she hosted African leaders as part of a concerted effort to drive the continent’s economic development and create jobs for its millions of unemployed youths.

In her opening address on Tuesday at the G20 Compact with Africa Summit, taking place in Berlin on 30-31 October, Merkel said her government will establish one-billion euro investment fund to help develop new markets in Africa.

“We, the German government, have met and reflected on how to take further action. We will create an investment fund for the development of small and medium-sized enterprises, both European and African. With this fund, participation and loans will be financed in order to enable, for example, the launch of new markets”, Merkel said.

“The state will not be able to assume the full risk,” Merkel says. But her government wants to do significantly more to support German investors in Africa. The so-called Hermes Guarantees are to be expanded in order to insure export transactions.

The German chancellor said the prosperity of Africa was in the interest of Europe, which is worried about the irregular migration of young Africans to the continent.

Conceived during the German presidency of the G20 last year, the Compact with Africa (CwA) initiative seeks to promote private sector investment in Africa to promote economic growth in the continent. The first phase of the initiative involves African countries considered to be serious in improving the climate for investment.

The Berlin Summit, being attended by eleven African leaders, including South African President Cyril Ramaphosa and Rwanda’s Paul Kagame, who presented the continent as a stable investment destination.

“And we can say unequivocally that Africa is indeed open for business. And we are delighted to have this opportunity for African countries to present viable, bankable and investable projects. We invite you to take a greater interest in our continent. Thank you very much,” Ramaphosa said.

Kagame said “as a result of the financial and institutional reform, the African Union has achieved savings of 12 per cent in its next budget and Member States are paying a larger share of the bill. We have also signed agreements on the free movement of people and a continental free trade area, the FTA, making Africa a single trading bloc”.

The CwA is a partnership of the G20, World Bank Group, International Monetary Fund and African Development Bank to stimulate private investment in Africa. The basic premise of the Compact is that macroeconomic stability, an investor-friendly business environment, and effective financial sector intermediation are necessary conditions to spur private investment. G20 member countries commit to encourage their companies to invest in the Compact partner countries.

Compact countries are Benin, Côte d’Ivoire, Egypt, Ethiopia, Ghana, Guinea, Morocco, Rwanda, Senegal, Togo and Tunisia.

Sola Jolaoso with agency reports

THE AFRICAN COURIER. Reporting Africa and its Diaspora! The African Courier is an international magazine published in Germany to report on Africa and the Diaspora African experience. The first issue of the bimonthly magazine appeared on the newsstands on 15 February 1998. The African Courier is a communication forum for European-African political, economic and cultural exchanges, and a voice for Africa in Europe.

THE AFRICAN COURIER. Reporting Africa and its Diaspora! The African Courier is an international magazine published in Germany to report on Africa and the Diaspora African experience. The first issue of the bimonthly magazine appeared on the newsstands on 15 February 1998. The African Courier is a communication forum for European-African political, economic and cultural exchanges, and a voice for Africa in Europe.